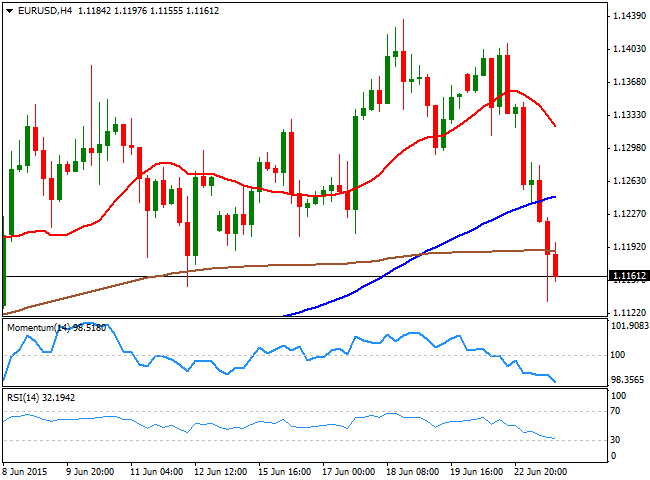

Mirror trading is one of the many ways that investors can diversify their crypto portfolio. By allocating funds to multiple, more experienced traders with different strategies, you can spread out your risk and simultaneously increase your returns. The downside is that there is less control of individual trades as they are out of the trader’s hands.

- Mirror trading was initially only available to institutional clients but has since been made available to retail investors through various means.

- Moomoo makes no representation or warranty as to its adequacy, completeness, accuracy or timeliness for any particular purpose of the above content.

- Thus, investors should carefully consider the fees charged by the platform and the impact on their overall returns in order to avoid unpleasant surprises when mirror trading fees are due.

- Mirror trading helps to remove a part of this variable, enabling traders to concentrate only on the aspects of the market in which they excel.

They can watch experienced traders trade, ask questions, and get clarifications of why a particular move was made. However, it’s important to be aware of any laws that are applicable in your area. You also have to make sure you’re using a regulated broker and following your area’s laws. It’s also worth mentioning that it can be very risky if you don’t mirror the right traders. Fortunately, mirror trading doesn’t take much experience for most people.

Analyse the trading orders

You should consider whether you understand how these products work and whether you can afford to take the high risk of losing your money. Since 2005 the Mirror Trader platform has gained popularity with tens of leading financial institutions. The Mirror Trader’s popularity derives from its real, tangible value for traders. Mirror Trading is the core concept behind the unique offering of the Mirror Trader, Tradency’s innovative trading platform. The Mirror Trader is the largest technology provider for brokers with over 200 brokers and 2M retail clients users since 2005.

- The Mirror Trader presents detailed summary of the strategies performance, helping traders making educated choices.

- Furthermore, clients can also engage in multiple strategies simultaneously, which makes this a particular draw.

- We have members that come from all walks of life and from all over the world.

- You can have a mentor who helps you learn trading and doesn’t force you to eat out of his hand.

- By following the trade recommendations of multiple traders, you can gain exposure to a range of different markets and strategies.

The value of shares and ETFs bought through a share dealing account can fall as well as rise, which could mean getting back less than you originally put in. Information contained on this website is general in nature and has been prepared without any consideration of

customers’ investment objectives, financial situations or needs. Customers should consider the appropriateness

of the information having regard to their https://currency-trading.org/education/learn-how-to-trade-the-market-in-5-steps/ personal circumstances before making any investment decisions. With the development of financial instruments and digital tools, mirror trading gradually entered the portfolios of companies. Such methods are helpful in diversifying a trader’s portfolio, while also managing the level of risk. Mirror trading is completely free to use, and allows you to buy templates, strategies or signals and trade autonomously.

What is veTokenomics? An analysis on the…

All these things could turn out to be very negative…for your account. Learning price action is going to be your best bet if you want to be an independent trader. It is a good https://trading-market.org/spinning-top/ way to enter a new market, with low effort, and a way to learn without imparting emotional trading. However, it is not the secret weapon to guarantee the best results.

We put all of the tools available to traders to the test and give you first-hand experience in stock trading you won’t find elsewhere. We don’t care what your motivation is to get training in the stock market. If it’s money and wealth for material things, money to travel and build memories, or paying for your child’s education, it’s all good. We know that you’ll walk away from a stronger, more confident, and street-wise trader. It’s going to be a lot harder to find a strategy to use when the market is trading in a range.

Build your skills with a risk-free demo account.

A Russian customer of Deutsche Bank Moscow bought Russian securities against ‘Russian Ruble’ from Deutsche Bank Moscow (the “Moscow side”). At the same time, a non-Russian customer of Deutsche Bank sold the same number of the same securities to Deutsche Bank in exchange for US dollars (the “London side”). Mirror trading is something that has emerged for the new digital age of trading. It is a strategy that only really works in digital trading, but also one that suits this digital age. Traders of today like quick results, easy trades, and low effort — as well as new markets.

Unibot: The Crypto Revolution or Overhyped Fad? – Captain Altcoin

Unibot: The Crypto Revolution or Overhyped Fad?.

Posted: Thu, 13 Jul 2023 09:35:16 GMT [source]

However, with so many mirror trading platforms available, it can be difficult to know where to start your search. In this blog post, we will provide some tips for finding the best mirror trading platform for your needs and explain how it can benefit your investing strategies. Investopedia defines mirror trading as a methodology of trade selection used primarily in forex markets. It is a strategy that allows investors to copy the trades of experienced and successful forex investors and implement the same trades, in almost real-time, in their own accounts.

Join us on Telegram and get real-time alerts on

There are a number of other strategies that can be more successful than mirror trading in the long run, but they will require more time and effort, and experience. When you decide to mirror trade you are essentially aligning yourself to the movies that another trader makes. This means that your account ties into their trades and executes the same trades.

Lack of emotional self-control is a primary factor contributing to many people’s failure to establish successful trading careers. Mirror trading is popular for its hands-off approach by investors who do not need to intervene at all to execute even complex trading strategies. Trading signals are delivered and executed automatically with both exit and entry points across many commonly traded currency pairs. Aspiring traders can access Tradenet’s YouTube channel to watch Meir, Scott, and other analysts trade live and to gain access to their past performance videos. At the same time, they can also become a part of Tradenet’s live trading chat room. Meir Barak is a leading Wall Street expert and has successfully trained and mentored thousands of aspiring traders.

What Is Mirror Trading?

And since the crypto market is a volatile one, all bots are backtested in different market conditions such as bull, bear and sideways market regimes to ensure consistent returns. It’s this uncompromising commitment to a transparent bot evaluation process that distinguishes Trality’s Marketplace from generic, black-box alternatives. Just because they are similar, doesn’t mean that these terms can be used interchangeably.

Just choose the course level that you’re most interested in and get started on the right path now. When you’re ready you can join our chat rooms and access our Next Level training library. Our content is packed with the essential knowledge that’s needed to help you to become a successful trader. We have members that come from all walks of life and from all over the world.

With the automated crypto trading bot of Cryptohopper you can earn money on your favorite exchange automatically. Auto buy and sell Bitcoin, Ethereum, Litecoin and other cryptocurrencies. Trading and ancillary will not recommence, and the brand/platform will be https://day-trading.info/activtrades-opens-a-new-office-in-nassau/ permanently discontinued. Well, that curiosity led me on a fascinating journey of surveying over 1500 traders. Navdeep has been an avid trader/investor for the last 10 years and loves to share what he has learned about trading and investments here on TradeVeda.

Mirroring-of-trades case settled for Rs 44 lakh by one of three investigated – CNBCTV18

Mirroring-of-trades case settled for Rs 44 lakh by one of three investigated.

Posted: Fri, 07 Jul 2023 10:44:51 GMT [source]